IDBI Bank launches automated Loan Processing System for MSMEs

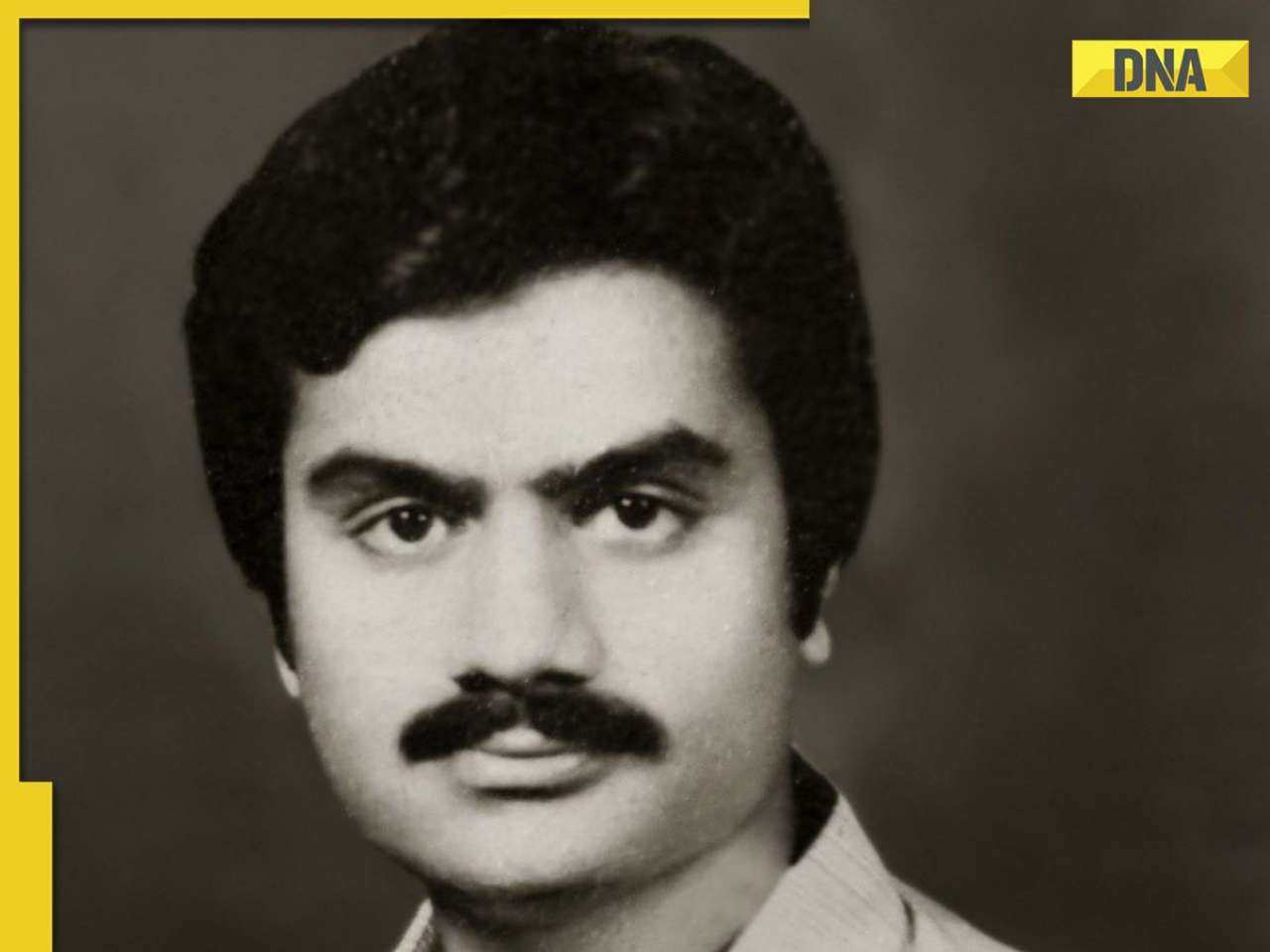

IDBI Bank Limited announced the launch of its fully digitised, end-to-end, Loan Processing System (LPS) for its MSME and Agri products. This new loan processing system seamlessly integrates with data fintechs, bureau validations, document storage/retrieval, account opening/management, customer notifications, and portfolio management capabilities along with embodied policy/knock off parameters. These features of the fully digitised and automated loan processing system are further aimed at providing a superior tech-enabled banking experience to bank’s MSME & Agri.customers. Suresh Khatanhar, Deputy Managing Director, IDBI Bank, stated that, ‘LPS would carry a total of more than 50 product lines and would offer seamless credit lifecycle with over 35 interface touch points to many satellite systems. The LPS integrates with the existing core database, human resource management system, and various other applications of the Bank.

Source: Mint May 19, 2021 07:20 UTC