Century-old jab is sole defence

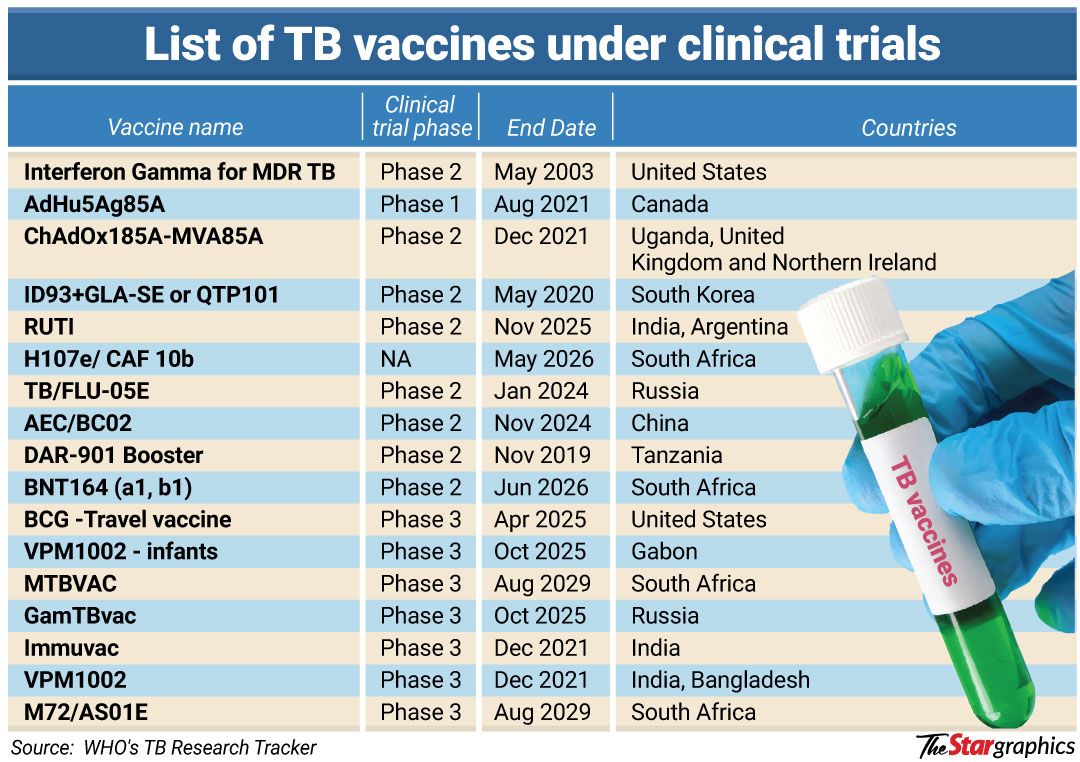

PETALING JAYA: The 100 year-old Bacillus Calmette-Guerin (BCG) vaccine is still the world’s only defence against one of its deadliest infectious diseases – tuberculosis. “The BCG vaccine does not give lifetime protection. “TB Vaccines are generally not recommended for adults. “For children, BCG protection wanes over time, typically within five to 15 years. “Currently, there is no recommendation for routine TB vaccination in adults in Malaysia.

Source:The Star

February 20, 2026 01:05 UTC

Smaller bikes face bigger risks

He said that between 85% and 90% of the almost 16.8 million registered motorcycles in the country are kapchai, or small-capacity, models. ALSO READ : Road safety experts: Smart lanes a double-edged swordDespite it being a “lightweight”, he said the kapchai is often capable of speeds beyond 110kmph. “Road safety interventions, which focus on commercial and passenger vehicles, should no longer continue ignoring the elephant in the room. Suret said statistics show that 34% of fatalities involving smaller bikes occur on federal roads, 32% on state roads, 22% on municipal roads and 12% on expressways. Universiti Putra Malaysia Road Safety Research Centre head Assoc Prof Law Teik Hua noted that many Malaysians perceive the use of rear seat belts as “optional”.

Source:The Star

February 20, 2026 01:05 UTC

Road safety experts: Smart lanes a double-edged sword

PETALING JAYA: With traffic snarls along highways worsening, local highway concessionaires have introduced “smart lanes” as a quick fix to ease flow. However, experts say the move should not come at the expense of road safety. These international examples, he said, showed that smart lanes can work in Malaysia but only if robust safeguards are in place. Smart lanes should operate strictly during genuine peak-hour congestion and must be closed once traffic eases. Road Safety Council of Malaysia executive council member Datuk Suret Singh said smart lanes should not displace emergency lanes, which were in place to facilitate the efficient deployment of rescue vehicles for major road incidents and disasters such as landslides.

Source:The Star

February 20, 2026 00:55 UTC

Stable meal prices despite festive rush

“They are working during the festive period as well, catering to our needs while many of us are off from work. No one has complained,” she said, adding that she sells an additional 15 to 20 plates daily during the festive season. Ken Teh, 50, who sells chicken rice, has opted to maintain his regular prices, as he does not want his customers to incur extra expenses. “I know that many hawkers raise their prices, citing the increased cost of ingredients and their decision to work during the festive season, but I feel bad. He said he could increase prices, particularly because many of his customers are foreigners or from out of town and might not be familiar with the regular prices but he has opted not to do so.

Source:The Star

February 20, 2026 00:49 UTC

HSBC cuts 10% of US debt capital markets team amid overhaul — Bloomberg

(Feb 20): HSBC cut 10% of its US-based debt capital markets (DCM) team, continuing to cull costs after announcing a revamp of the business last October, according to people familiar with the matter. The employees included one managing director, two directors, two associates and one analyst, according to one of the people. HSBC also pulled back from M&A and equity capital markets in the UK, Europe and the US to focus on Asia and the Middle East. HSBC is set to report earnings on Wednesday after its US rivals posted strong results during the fourth quarter. The bank has been consistently among the top 10 underwriters for US corporate debt sales over the past three years, according to data compiled by Bloomberg.

Source:The Edge Markets

February 20, 2026 00:32 UTC

US amasses forces as Trump says Iran has just days for deal

“We’re either going to get a deal, or it’s going to be unfortunate for them,” Trump told reporters on Thursday aboard Air Force One. On a deadline, Trump said he thought 10 to 15 days was “pretty much” the “maximum” he would allow for negotiations to continue. The deployment is unlike anything the US has done since 2003, when it amassed forces before the invasion of Iraq. It dwarfs the military buildup that Trump ordered off the coast of Venezuela in the weeks before he ousted President Nicolas Maduro. “Maybe we’re going to make a deal,” Trump said in a speech on Thursday morning.

Source:The Edge Markets

February 20, 2026 00:27 UTC

Global shares climb as risk appetite holds firm, US-Iran tensions boost oil

The pan-European STOXX 600 index rose 0.5% and was on track for its fourth consecutive week of gains. The session will wrap up a volatile week for global assets, with investors grappling with a blend of geopolitical flashpoints, political risks and shifting economic signals. "Clearly, equity investors are getting used to the noisy geopolitical environment," said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers. For the week, the dollar is up about 1% on the euro EUR=, pushing the common currency to US$1.1767. Taken together, the news had investors shying away from risk, said Kenji Abe, chief strategist at Daiwa Securities in Tokyo.

Source:The Edge Markets

February 19, 2026 23:36 UTC

Qatar Airways’ new CEO eyes better ties with Airbus

DOHA: About a month into his tenure as Qatar Airways Group’s chief executive officer (CEO), Hamad Al-Khater made certain his first overseas trip took him to the French headquarters of planemaker Airbus SE. “They’ve demonstrated that commitment that they’ll be able to deliver on the promises.”The European manufacturer’s planes were among the first to fly for Qatar Airways, and they now comprise about half of its fleet. “We’re in a safe space as Qatar Airways.”The new CEO is the airline’s second in three years. Those will be phased out as Qatar Airways ramps up to nearly 400 jets by 2040. “At this stage in time, it’s a continuous evaluation of our fleet order,” Al-Khater said.

Source:The Star

February 19, 2026 23:34 UTC

US stocks decline as US-Iran risks spur rally in oil

(Feb 20): Heightened geopolitical worries sent stocks lower while extending a surge in oil and keeping a lid on bonds amid perceived inflation risks. Walmart Inc slid on a conservative outlook, but the giant retailer’s comparable sales in the US beat expectations. Iran is a “hot spot” right now even as officials from both sides engage in “good talks”, Trump said. A potential war would put flows at risk from a region that pumps about a third of the world’s oil. “Crude oil prices are rising on the anticipation of possible military action in Iran,” said Louis Navellier at Navellier & Associates.

Source:The Edge Markets

February 19, 2026 23:31 UTC

FBG unit secures hotel project for RM238.09mil

KUALA LUMPUR: FBG Holdings Bhd, formerly known as Fajarbaru Builder Group Bhd , said its wholly-owned subsidiary FBG Builder SDn Bhd has accepted a contract from an indirect wholly-owned subsidiary of IGB Bhd for the development of a 25-storey hotel building block (Tower 6) containing 375 rooms with facilities on top of the existing The Mall, Mid Valley Southkey, in Plentong, Johor Bahru. In a filing with Bursa Malaysia, the group said the contract inked with MVS Southpoint Hotel Sdn Bhd is valued at RM238.09mil. The contract will commence on March 1, 2026, and be completed on June 30, 2028. It is expected to contribute positively to the earnings of the group for the financial years ending June 30, 2026, onwards.

Source:The Star

February 19, 2026 22:30 UTC

Drought deepens hunger in northern Kenya as aid cuts bite

TURKANA, Kenya, Feb 19 (Reuters) - Four years after a record drought devastated northern Kenya, failed rains are once again causing starvations, with aid cuts forcing agencies to scale back their efforts and feed fewer people. The family's difficulties have mounted after her son was killed a fortnight ago in a cattle rustling raid while herding animals. Sarah Ayodi, the head of WFP's field office in Turkana, told Reuters that 333,000 people in the county required food aid, but said the agency would not be able to support them after next month. You can't survive here because of drought ... even trees and wild fruits are nowhere to be seen, not even a green leaf," Akol said. The drought has also left a visible trail of loss in Kenya, with cattle carcasses seen across landscapes inhabited by pastoralists.

Source:The Star

February 19, 2026 22:10 UTC

T'ganu beachgoers warned not to touch jellyfish that wash ashore

KUALA NERUS: The public has been warned not to touch venomous jellyfish that washed ashore at several beaches in Terengganu. As such, she said the assumption that these jellyfish are harmless once dead and washed ashore is incorrect. "The use of vinegar to alleviate the pain of a sting remains a subject of debate and is only suitable for certain species. "Fishermen or individuals engaged in angling activities must also be cautious when handling jellyfish caught in their nets," she added. Over the past few days, the presence of these venomous jellyfish has been detected once again at several popular tourist locations, including Pantai Pandak in Cendering and Pantai Paka in Dungun.

Source:The Star

February 19, 2026 22:05 UTC

Brazil's GDP grows 2.5 pct in 2025

BRASILIA, Feb. 19 (Xinhua) -- Brazil's gross domestic product (GDP) expanded 2.5 percent in 2025 from a year earlier, according to data released Thursday by the country's central bank. The growth was mainly driven by the agricultural sector with an increase of 13.1 percent, while services grew by 2.1 percent and industry by 1.5 percent. The latest economic data has bolstered market expectations of a potential interest rate cut in March by the monetary policy committee of the central bank.

Source:The Star

February 19, 2026 21:14 UTC

Trump tells first meeting of Board of Peace that US$7b raised for Gaza

He said contributing nations had raised US$7 billion as an initial down payment for Gaza reconstruction. Trump first proposed the board last September when he announced his plan to end Israel's war in Gaza. Trump also said Fifa will raise US$75 million for football-related projects in Gaza and that the United Nations will chip in US$2 billion for humanitarian assistance. "We're going to strengthen the United Nations," Trump said, trying to assuage his critics. In Gaza, Hamas spokesperson Hazem Qassem said any international force must "monitor the ceasefire and prevent the (Israeli) occupation from continuing its aggression".

Source:The Edge Markets

February 19, 2026 15:35 UTC

Water supply schedule in Kluang, Pontian suspended for 48 hours

JOHOR BAHRU: The Scheduled Water Supply (BAB) programme in the Kluang and Pontian districts has been suspended for 48 hours beginning at midnight on Thursday (Feb 19). Johor water operator Ranhill SAJ announced that the suspension follows encouraging improvements in dam levels supplying raw water to several treatment plants in the two districts. "The suspension of the Scheduled Water Supply took effect at midnight," it said. According to the statement, if raw water levels remain stable after 48 hours, the implementation of the BAB will be discontinued. The BAB was implemented on Feb 7, with water supply distributed for 36 hours, followed by 36 hours without water.

Source:The Star

February 19, 2026 15:30 UTC

.jpg)