Civil Defense helps transfer 300kg patient to hospital using lorry

JERTIH: The Malaysian Civil Defence Force (APM) in Besut on Thursday (Feb 19) transferred an obese patient, weighing more than 300kg, from Besut Hospital here to Sultanah Nur Zahirah Hospital (HSNZ) in Kuala Terengganu, using a lorry. "APM received an emergency call from the hospital on Thursday morning, requesting special assistance to transport the patient, who had to be placed under sedation, to HSNZ. "We had transported the same patient from his home in Kampung Padang Luas to Besut Hospital on Wednesday (Feb 18), using the same lorry, before he was referred to HSNZ on Thursday,” he said when contacted by Bernama. He said that the patient, accompanied by a medical officer and several Besut Hospital staff, arrived safely at HSNZ at about 2.30pm, with five district APM personnel involved in the operation. Meanwhile, the patient’s elder brother Muhamad Shafik Juraimi, 33, said that his younger brother, Muhammad Azrol Haffiz, 28, was taken to the Emergency Unit of Besut Hospital at about 8pm on Wednesday, due to a leg infection.

Source:The Star

February 19, 2026 13:58 UTC

Singapore PM Wong to make special visit to Malaysia tomorrow

KUALA LUMPUR: Singapore Prime Minister Lawrence Wong will undertake a special visit to Malaysia on Friday (Feb 20), during which he is scheduled to meet Prime Minister Datuk Seri Anwar Ibrahim. The Foreign Ministry said in a statement that both prime ministers are expected to discuss bilateral cooperation and issues of mutual interest, including the outcomes of the recent Leaders’ Retreat on Dec 4, 2025. Singapore is Malaysia’s neighbour and key partner in Asean, with close and extensive relations in various fields. Singapore is Malaysia’s second-largest trading partner with total trade reaching RM402.35bil (US$93.97bil) in 2025, an increase of 1.5 per cent compared with 2024.- Bernama

Source:The Star

February 19, 2026 12:44 UTC

Over RM8mil in drugs seized, five nabbed in KL, Selangor raids

SHAH ALAM: A drug distribution ring has been busted with the arrest of five suspects, all Malaysians aged 27 to 37, in a police sweep. Bukit Aman Narcotics Crime Investigation Department (NCID) director Comm Datuk Hussein Omar Khan said several raids were conducted in Kuala Lumpur and Selangor on Feb 12 under Ops Bena. Investigations showed that syndicate had been active since July and operated by hiding drugs inside vehicles left at specific locations before being collected by buyers. Comm Hussein added that the suspects are believed to have links with organised crime. Two suspects have been granted police bail while the rest have been remanded for 13 to 14 days each from Feb 13, he said.

Source:The Star

February 19, 2026 12:08 UTC

85% of TB cases involve Malaysians

PETALING JAYA: Some 85% of reported tuberculosis (TB) cases in the country involved Malaysians, says Datuk Seri Dr Dzulkefly Ahmad (pic). The Health Minister said this data is contrary to public sentiment, as foreigners account for only 15% of reported TB cases. “Recently, various perceptions have emerged linking the spread of TB to the influx of foreign nationals. “Data from the Health Ministry confirms that 85% of reported cases involve local citizens, while only 15% involve foreigners. On Monday, the Health Ministry said a total of 503 new TB cases were detected nationwide as of the fifth epidemiological week of this year, bringing the cumulative total to 2,571 cases.

Source:The Star

February 19, 2026 12:04 UTC

Global pepper prices expected to rise in 2026

KUCHING: Global pepper prices are expected to trend upward in 2026 in view of continued tight supply as demand is outstripping supply. William SC Yii, director of leading pepper exporter Nguong Aik (Kuching) Sdn Bhd foresees the current global pepper prices will either be maintained or go up by 10% to 15% from current levels. “The global white pepper now fetches between US$11,500 and US$12,200 per tonne and black pepper between US$8,300 and US$9,000 per tonne,” he said. The IPC forecasts that the global pepper market will continue to grow, driven by increasing demand from various industries. On Malaysian pepper, Yii said although the published prices by the Malaysian Pepper Board have come down as compared to a year ago, the prices of Sarawak Pepper (brand name for Malaysian pepper) have been stable in its traditional markets due to the tight supply.

Source:The Star

February 19, 2026 11:24 UTC

King orders no-holds-barred fight against graft in Johor

JOHOR: His Majesty Sultan Ibrahim, King of Malaysia, has warned that efforts to combat corruption must be carried out without compromise across all departments and agencies under the Johor government. His Majesty, who is also the Sultan of Johor, stressed that integrity and administrative transparency are fundamental to safeguarding the state’s well- being and sustained prosperity. Also in attendance were Pasir Gudang City Council Mayor Datin Paduka Hazlina Jalil and Johor Land and Mines director Mohammed Shakib Ali. Describing graft as a betrayal of public trust, the King said such acts will not be tolerated in the country’s administration under any circumstances. “Do not think the fight against corruption is only focused on a handful of departments or those who give and receive bribes.

Source:The Star

February 19, 2026 11:15 UTC

Festive spirit brings M’sians together

KUALA LUMPUR: Every Chinese New Year, G. Vassagi, 75, makes it a point uphold a meaningful family tradition – attending the festive open house at Wisma MCA. “In Malaysia, all festivals are celebrated together, filled with warmth and mutual respect among the various races.”Vassagi described the open house as lively with energetic lion dance performances and fireworks. Family time: Vassagi (centre) and her family celebrating Chinese New Year at the MCA open house at Wisma MCA in Kuala Lumpur. For housewife Putri Dewi Astuty, 41, her maiden visit to the MCA open house was motivated by her eight-year-old daughter’s curiosity. The celebration also left a strong impression on a foreigner experiencing the open house for the first time.

Source:The Star

February 19, 2026 11:10 UTC

Bazaars under close watch for profiteering

PETALING JAYA: The supply and prices of goods at Ramadan and Aidilfitri bazaars will be monitored to ensure no profiteering or hoarding, says the Domestic Trade and Cost of Living Ministry. Minister Datuk Seri Armizan Mohd Ali (pic) said that an operation called Ops Pantau will be carried out from today to March 20, in preparation for Hari Raya Aidilfitri. “We are also monitoring Ramadan bazaars and Aidilfitri bazaars to ensure there is no sale of counterfeit goods or online sales that violate the laws. “KPDN enforcement officers nationwide will be deployed to strategic locations and targeted areas such as Ramadan bazaars, Aidilfitri bazaars, public markets, wet markets, morning markets, night markets, farmers’ markets, hypermarkets, supermarkets, mini-markets, grocery stores, and online sales platforms. Last year saw a total of more than 96,500 stalls operating at Ramadan and Aidilfitri bazaars nationwide, with Selangor recording the highest number of stalls at around 15,000.

Source:The Star

February 19, 2026 11:09 UTC

SC appoints Abdulkader Thomas as first Sultan Nazrin Shah Fellow

KUALA LUMPUR (Feb 19): The Securities Commission Malaysia (SC) has appointed Dr Abdulkader Thomas as its inaugural Sultan Nazrin Shah Fellow to help drive thought leadership and innovation in Islamic finance. In a statement on Thursday, the SC announced that the appointment, effective Nov 1, 2025, follows the endorsement of the Sultan of Perak, Sultan Nazrin Shah, who is also the royal patron for Malaysia’s Islamic finance initiative, earlier this month. Abdulkader is an established author in the field of Islamic finance, having served senior roles, including as the publisher and chief executive officer of the American Journal of Islamic Finance. The Sultan Nazrin Shah Fellowship, commenced in November 2025, was founded on the long-standing relationship between the SC and the Oxford Centre for Islamic Studies (OCIS), spanning over 15 years. Since 2010, this partnership has fostered sustained dialogue on the evolution of Islamic finance through the annual SC-OCIS Roundtable, shaping thought leadership and forward-looking perspectives for innovative solutions in the Islamic capital market.

Source:The Edge Markets

February 19, 2026 10:48 UTC

Indonesia bond auction weak but not distressing, central bank policy decision awaited

The result — not exactly calming but not overly concerning — comes after investors have been unnerved by setbacks for Southeast Asia's biggest economy, putting the bond market and rupiah under the microscope. On Thursday, the currency softened 0.3% to 16,933 as the US dollar firmed ahead of a Bank Indonesia policy decision later in the day. Foreign sentiment for bonds seen stableIndonesia raised a higher-than-targeted 40 trillion rupiah (US$2.4 billion) from its regular bond auction on Wednesday in its first bond offering since Moody's downgrade. "Foreign sentiment for rupiah bonds has remained largely stable," said Winson Phoon, the regional head of fixed income research at Maybank. "No sign of a drastic change in foreign positioning although foreign holdings have dipped slightly over the past one week."

Source:The Edge Markets

February 19, 2026 10:43 UTC

Tech chiefs address India AI summit as Bill Gates cancels

Gates, facing questions over his ties to late sex offender Jeffrey Epstein, withdrew just hours before his speech to "ensure the focus remains on the AI Summit's key priorities", the Gates Foundation said. The AI Impact Summit is the fourth annual international gathering focused on the rapidly advancing field, following previous summits in Paris, Seoul and Britain's wartime code-breaking hub Bletchley. Another Gates Foundation official will take the place of Gates, who said this month he regrets "every minute" he spent with Epstein. Brazil's President Luiz Inacio Lula da Silva is in town to attend the AI summit and hold talks with Modi, including on rare earths. Some say the broad focus of the event and vague promises made at previous global AI summits mean that concrete commitments are unlikely.

Source:The Star

February 19, 2026 10:25 UTC

Michelle Yeoh immortalised in Hollywood Walk of Fame

KUALA LUMPUR: Malaysian-born actress Michelle Yeoh, who has made a name for herself in Hollywood, continues to bring pride to the nation. Yeoh's name was immortalised on the Hollywood Walk of Fame in Los Angeles on Wednesday (Feb 18), in recognition of her outstanding contributions to the international film industry. The 64-year-old actress graced the red carpet in an elegant yellow gown with minimal accessories, radiating sophistication throughout the prestigious event organised by the Hollywood film community. In an Instagram post, Yeoh reflected on her journey from Malaysia to Hollywood, acknowledging that it was far from easy and full of challenges before reaching her current status. "The star may carry one name, but it represents so many people who made this journey possible.

Source:The Star

February 19, 2026 10:25 UTC

Trio get jail, RM128.9mil in fines for illegal possession of wildlife parts

KUANTAN: Three Vietnamese nationals, including two siblings, have been fined a total of RM128.9mil million and given jail terms ranging from 15 months to 12 years for illegal possession of wildlife parts. Sessions judge Maimoonah Aid handed down the sentences on Bui Thi Ngan, 56, her brother Bui Van Noi, 48, and a male friend, Bui Van Anh, 38, after finding the trio guilty of the offences on Thursday (Feb 19). She also ordered that they serve the prison sentences concurrently from the date of their arrest. The accused will also serve an additional eight years and six months’ jail if they fail to pay the fines. They were jointly charged with committing the offences at a residential premises in Jalan Sungai Lembing, Kampung Sungai Charu, Panching here at 7pm on Nov 15, 2023.

Source:The Star

February 19, 2026 10:19 UTC

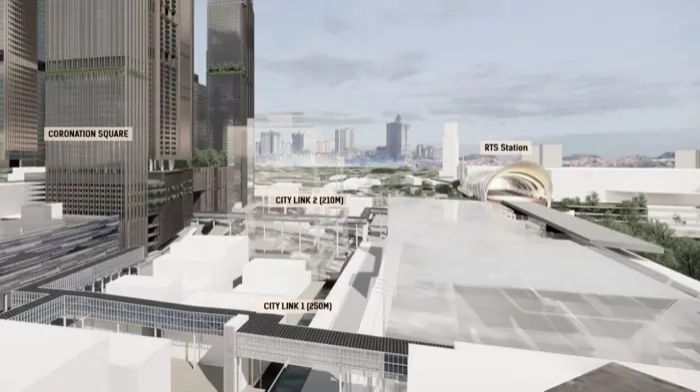

Coronation Square set to redefine Johor Baru

In Johor Baru, that alignment is now taking shape at the RM5bil integrated Coronation Square, spanning 9.6 acres, where urban redevelopment meets the RTS. For decades, Johor Baru has lived in the long shadow of its neighbour across the Causeway. Coronation Square’s direct integration with it, offers a chance to rewrite that narrative, and give Johor Baru better optics. When Johor Baru is connected by fast, reliable rail, movement becomes predictable and almost everything evolves. The shopping mall at Coronation Square should not be another retail outlet but as social infrastructure.

Source:The Star

February 19, 2026 09:58 UTC

Man turns fishing hobby into wooden lure business

Compiled by DIVYA THERESA RAVI and TAN SIN CHOWWHAT began as a simple fishing hobby at the age 25, has grown into an international business crafting handmade wooden fishing lures, Sinar Harian reported. Mohd Abdullah Said, 46, also known as Pak Tam, has expanded his Kuantan business into Indone-sian, Brunei and Singaporean markets. “At first I followed my friends and saw how Thais made wooden bait and attempted to make it too. “Among the designs produced include lizards and frogs that are adapted to local fishing techniques,” he explained, adding that prices range from RM15 to RM40. > For nearly two decades, Norida Akmal Ayob has not been able to spend Ramadan in Malaysia, but this year, she’s coming home, Kosmo!

Source:The Star

February 19, 2026 09:54 UTC