Oil up over Libya disruptions, US demand euphoria

Necessary CookiesThis cookie is used to distinguish between humans and bots. This is beneficial for the web site, in order to make valid reports on the use of their web site. Performance/Analytical CookiesRegisters a unique ID that is used to generate statistical data on how the visitor uses the website.Used by Google Analytics to throttle request rate. Accept RejectAdvertising/Marketing CookiesThis cookie is used to collect information on consumer behavior, which is sent to Alexa Analytics. (Alexa Analytics is an Amazon company.)

Source:Libya Today

January 04, 2024 10:06 UTC

WTI extends gains to near $73.00 on Israel-Gaza conflict, Libya oilfield disruption

Crude oil prices received additional support from the Weekly Crude Oil Stock data released by the American Petroleum Institute (API) on Wednesday. Moreover, anticipation builds as the Energy Information Administration (EIA) is set to release the US Crude Oil Stocks Change on Thursday. West Texas Intermediate (WTI) price trades higher near $73.00 per barrel during the Asian session on Thursday. Furthermore, disruptions at an oilfield in Libya are contributing to the strengthening of Crude oil prices. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Source:Libya Today

January 04, 2024 09:48 UTC

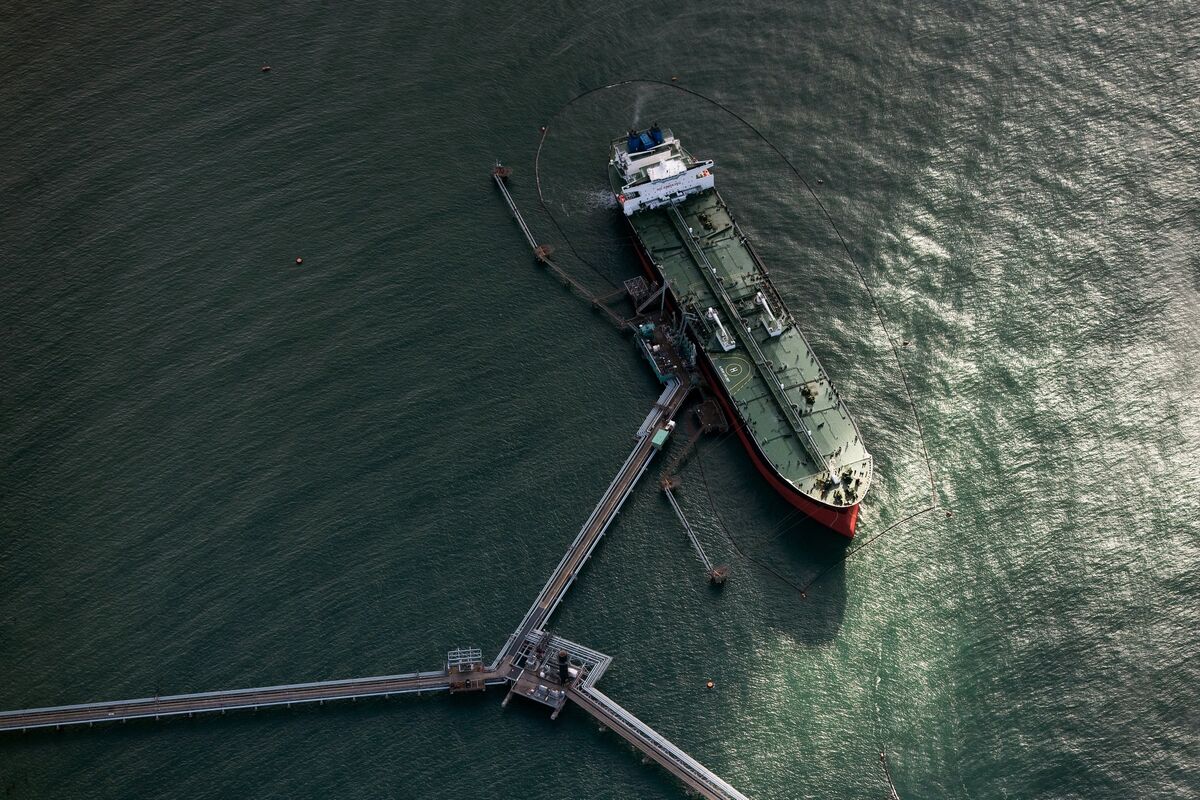

Libya's largest oil field shut by protestors, again

The Sharara oil field is managed by Spain's Repsol, France's TotalEnergies, Austria's OMV, and Norway's Equinor. Libya's National Oil Company (NOC) did not immediately respond to a request for comment. Protesters shut down production at Al-Sharara oilfield over shortage of fuel in Libya’s southern region of Fezzan. The #Libya Update pic.twitter.com/ow5USF8pwl— The Libya Update (@TheLibyaUpdate) January 2, 2024The Sharara field, one of Libya's largest, has been a frequent target for local and broader political protests. Libya's oil output has been disrupted repeatedly in the chaotic decade since the 2011 NATO-backed uprising against Muammar Gaddafi.

Source:Libya Today

January 04, 2024 08:29 UTC

Latest Oil Prices, Market News and Analysis for Jan. 3

Bloomberg Daybreak AsiaLive market coverage co-anchored from Hong Kong and New York. Overnight on Wall Street is daytime in Asia. Markets never sleep, and neither does Bloomberg. Track your investments 24 hours a day, around the clock from around the world.

Source:Libya Today

January 04, 2024 08:27 UTC

Oil prices rise again on increased chance of disruptions to Middle East supply By Investing.com

LCO 0.00% Add to/Remove from Watchlist CL -0.10% Add to/Remove from WatchlistInvesting.com -- Oil prices rose Thursday, adding to the previous session’s gains on increased concerns over the potential for supply disruptions from the crucial Middle East region. By 09:25 ET (14.25 GMT), the futures traded 0.8% higher at $73.25 a barrel and the contract climbed 0.5% to $78.66 a barrel. Risk of supply disruptions risesBoth contracts surged around 3% on Wednesday after protests over high fuel prices caused Libya’s El Sahara oil field to halt production, with the field producing about 300,000 barrels per day. A survey by the news agency points to the group’s output falling by a marginal 40,000 barrels a day in December month-on-month. “Given that some OPEC+ members agreed on additional voluntary cuts of almost 900,000 bbls/d for 1Q24, OPEC output will edge lower this month,” analysts at ING said, in a note.

Source:Libya Today

January 04, 2024 08:04 UTC

Oil prices rise again on increased chance of disruptions to Middle East supply

Investing.com -- Oil prices rose Thursday, adding to the previous session’s gains on increased concerns over the potential for supply disruptions from the crucial Middle East region. Risk of supply disruptions risesBoth contracts surged around 3% on Wednesday after protests over high fuel prices caused Libya’s El Sahara oil field to halt production, with the field producing about 300,000 barrels per day. Tensions are growing in the Middle East, and although supply from this crucial region has yet to be seriously impacted traders are beginning to add a premium given the growing possibility that this occurs. “Given that some OPEC+ members agreed on additional voluntary cuts of almost 900,000 bbls/d for 1Q24, OPEC output will edge lower this month,” analysts at ING said, in a note. Related ArticlesOil prices rise again on increased chance of disruptions to Middle East supplyOil steadies as Middle East supply worries balance economy concernsGold slips below $2,050 as dollar rebounds amid Fed uncertainty

Source:Libya Today

January 04, 2024 06:32 UTC

Asian stocks waver as traders ponder rate cut bets

China stocks remained under pressure, with uncertainties about a recovery in the world’s second-biggest economy keeping investors on the fence. Krosby said in an email the minutes underscored an “uncertain” policy path suggesting expectations for a rate cut in March may need to be ratcheted down further. Goldman Sachs analysts though still expect the first rate cut in March and five total cuts in the year, calling the comments in the minutes dovish. Fed officials in December predicted 75 bps of rate cuts in 2024, driving money-market bets for around double that amount amid market optimism that spurred a year-end rally in stocks and bonds. Benchmark 10-year Treasury yields briefly climbed above 4% on Wednesday before heading lower and were last at 3.920% in Asian hours.

Source:Libya Today

January 04, 2024 03:23 UTC

SpaceX Launches First Direct-to-Cell Starlink Satellites for Service With T-Mobile

SpaceX launched the first six Starlink satellites with direct to cell capabilities in its first mission of 2024 on Tuesday evening. SpaceX and partner T-Mobile say the service will provide coverage in cellular dead zones in the most remote locations. The first six direct to cell satellites will first be used to test the service in the United States, Jessie Anderson, SpaceX structures engineering manager said during the Jan. 2 webcast. This capability will first enable text messaging, and then voice and data coverage will follow after more satellites are launched. The Starlink satellites use partner spectrum to operate the service over their respective countries.

Source:Libya Today

January 04, 2024 02:29 UTC

Oil futures: Crude extends gains on Libya outages, Red Sea turmoil

Oil futures: Crude extends gains on Libya outages, Red Sea turmoilQuantum Commodity Intelligence – Crude oil futures in European trading hours Thursday were climbing higher as markets consolidated the previous session's firm gains of over 3%, which came after protests in Libya shut in output at the county's largest oil field. Front-month Mar24 ICE Brent futures were trading at $78.96/b (1230 GMT), compared to Wednesday's settle of $78.25/b. The threats to Libyan output add to the wider Middle East turmoil, with the security situation in and around the Red Sea deteriorating and forcing many ships, including oil and LNG tankers, to divert around the southern African coast. InventoriesCrude prices were neutral after data from the American Petroleum Institute revealed that crude inventories tumbled by 7.4 million barrels last week, beating forecasts for a drop of 3 million barrels. But the drop in crude stocks was more than offset by the products sector, with gasoline inventories up 6.9 million barrels and distillate stocks adding 6.7 million barrels to deliver a net build.

Source:Libya Today

January 04, 2024 02:23 UTC

Oil prices extend gains amid Libya disruptions, mixed US inventory data

Investing.com-- Oil prices rose slightly in Asian trade on Thursday, extending strong gains from the prior session as the shutdown of Libya’s biggest oilfield fueled more concerns over tight supplies. The shutdown came amid continued disruptions to shipping activity in the Red Sea, which markets feared could disrupt global oil supplies. Disruptions to Middle Eastern crude supply were a key point of support for oil prices in recent sessions, particularly on the grounds that they could result in tighter global oil markets in 2024. But the data also showed an outsized build in gasoline and distillate stocks, indicating that U.S. fuel demand remained weak. Protests over high fuel prices caused Libya’s El Sahara oil field to halt production, with the field producing about 300,000 barrels per day.

Source:Libya Today

January 04, 2024 02:22 UTC

Libya oil protests force partial reduction in production at Sharara oilfield - engineers

Jan 3 (Reuters) - Libya's oil protests forced a partial reduction in the oil production at Libya's Sharara oilfield, which produces 300,000 barrels per day, two engineers told Reuters on Wednesday. (Reporting by Ayman Werfalli in Benghazi, writing by Yomna Ehab and Louise Heavens)((yomna.ehab@thomsonreuters.com;))The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source:Libya Today

January 04, 2024 01:14 UTC

Oil prices rise more than 3% as U.S. warns Houthis against Red Sea attacks, OPEC pledges unity

Oil rose more than 3% on Wednesday as the U.S. warned Houthi militants against further attacks in the Red Sea and OPEC pledged to remain united in supporting prices. This comes a day after Danish shipping giant Maersk halted all shipping through the Red Sea until further notice due to repeated Houthi attacks on vessels. German shipping company Hapag-Lloyd confirmed Wednesday that it would continue to avoid the Red Sea. Oil prices have been volatile this week, with U.S. crude and the global benchmark settling more than 1% lower on Tuesday despite Maersk's decision to continue avoiding the Red Sea due to attacks by the Houthis. OPEC and its allies issued a statement Wednesday pledging to remain united in the group's "efforts to maintain oil market stability going forward."

Source:Libya Today

January 03, 2024 23:59 UTC

Qatar's Ambassador participates in meeting of Head of Libyan Government of National Unity with Ambassadors of Arab, African, Islamic States

QNATripoli: Ambassador of the State of Qatar to Libya HE Khalid Mohammed Al Dosari took part in the meeting of Head of the Government of National Unity in the State of Libya HE Abdul Hamid Muhammad Al Dbeiba with Their Excellencies ambassadors of the Arab, African and Islamic States accredited to Libya. During the meeting, Their Excellencies ambassadors were apprised of the latest political developments in Libya.

Source:Libya Today

January 03, 2024 23:14 UTC

Protesters Force Shutdown at Libya's 300,000 b/d Sharara Oilfield, Reports Say -- OPIS

Local protesters have halted production at the Libya's Sharara oilfield, according to Reuters and other media reports on Wednesday. The Sharara oilfield is one of the largest in Libya and can produce up to 300,000 bbl/day. It is operated by a joint venture between Libya's National Oil Company and Spain's Repsol, France's TotalEnergies, Austria's OMV and Norway's Equinor.

Source:Libya Today

January 03, 2024 22:47 UTC

Protests shut down Libya's Sharara oilfield

An engineer had earlier told Reuters a partial reduction in production had taken place and said that protesters were in front of the gate of the oilfield. The Sharara field, one of Libya's largest, has been a frequent target for local and broader political protests. It is run by state oil firm NOC via the Acacus company, with Spain's Repsol, France's Total, Austria's OMV, and Norway's Equinor. In July, production at the Sharara, Elfeel and 108 fields was stopped by tribal protesters over the abduction of a former finance minister. Libya's oil output has been disrupted repeatedly in the chaotic decade since the 2011 NATO-backed uprising against Muammar Gaddafi.

Source:Libya Today

January 03, 2024 20:57 UTC