Grok sexualized images spark global backlash

Grok sexualized images spark global backlashAFP, WASHINGTONElon Musk’s artificial intelligence (AI) tool Grok on Monday faced a growing international backlash for generating sexualized deepfakes of women and minors, with the EU joining the condemnation and Britain warning of an investigation. Screens display the logo of Grok, developed by xAI, and xAI founder Elon Musk in Toulouse, France, on Jan. 13 last year. “Grok is now offering a ‘spicy mode’ showing explicit sexual content with some output generated with childlike images. “We’ve identified lapses in safeguards and are urgently fixing them,” Grok said on X. Indian authorities on Friday last week directed X to remove the sexualized content, clamp down on offending users and submit an “Action Taken Report” within 72 hours, or face legal consequences, local media reported.

Source:Taipei Times

January 06, 2026 17:35 UTC

EDITORIAL: Taiwan’s view on Venezuela

Notably, her argument does not actually identify a need for re-evaluation; it simply uses the US’ action in Venezuela to reinforce the KMT’s longstanding position. That view suggests that it was a show of strength not just to China, but for the countries that choose to rely on China. A third perspective places the strategic position on dealing with “non-hemispheric competitors” front and center of the Venezuela action. That view is explained by Tzou Jiing-wen (鄒景雯), editor-in-chief of the Liberty Times (the Taipei Times’ sister newspaper), on this page (“Maduro’s capture is a dilemma for Beijing”). It was a show of US military strength, with precision and resolve that Beijing should not ignore.

Source:Taipei Times

January 06, 2026 17:35 UTC

Cambodia violated 10-day-old truce, Thailand says

Cambodia violated 10-day-old truce, Thailand saysACCIDENT? The Thai military said it warned Cambodian forces to exercise caution, stressing that if a similar incident occurred, Thailand might need to retaliate. “Cambodia has violated the ceasefire,” the Thai army said in a statement, accusing Cambodian forces of firing mortar rounds into Thailand’s Ubon Ratchathani Province. He added that Thailand had the “capability to respond” to Cambodia, which is vastly outgunned by its neighbor. Under the truce, Cambodia and Thailand pledged to cease fire, freeze troop movements and cooperate on demining efforts along the border.

Source:Taipei Times

January 06, 2026 17:35 UTC

Landmines destroy limbs and lives in Bangladesh

Ali Hossain, 40, was collecting firewood early last year when a blast shattered his life. It is crossed daily by villagers, as their families have done for generations, for collecting firewood or trading. Needing 300 takas (US$2.46) a day for medicine, his two young sons now take on his former dangerous task, collecting firewood after school. A Bangladesh border guard was killed in November last year when a landmine tore off both his legs. “This cruelty cannot be legitimized,” said Lieutenant Colonel Kafil Uddin Kayes, a local Border Guard Bangladesh commander.

Source:Taipei Times

January 06, 2026 17:35 UTC

At least 35 people killed in protests in Iran: activists

At least 35 people killed in protests in Iran: activistsAP, DUBAI, United Arab EmiratesThe death toll in violence surrounding protests in Iran has risen to at least 35 people, activists said yesterday, as the demonstrations showed no signs of stopping. Photo: ReutersThe group, which relies on an activist network inside Iran for its reporting, has been accurate in past unrest. The protests have become the biggest in Iran since 2022, when the death of 22-year-old Mahsa Amini in police custody triggered nationwide demonstrations. As sanctions tightened and Iran struggled after a 12-day war with Israel, its currency collapsed last month and the protests began soon after. Journalists in Iran also face limits on reporting in general, such as requiring permission to travel around the nation.

Source:Taipei Times

January 06, 2026 17:35 UTC

‘Necessary evils’ and strategic traps

Once powerful states begin treating international law as optional, the rules-based order begins to erode. Before World War II, repeated violations of international law were justified as necessary responses to ideological or security threats. By the time the world recognized that the “cure” was as destructive as the disease, the international system had already collapsed. In that world, legal norms, democratic values and moral arguments matter less than geography and strategic bargaining. Supporting the erosion of international norms today — even when politically tempting — weakens the very system Taiwan depends on tomorrow.

Source:Taipei Times

January 06, 2026 17:35 UTC

Israel strikes villages, towns in Lebanon

Israel strikes villages, towns in LebanonHEZBOLLAH, HAMAS TARGETS: The house targeted in al-Manara belonged to Sharhabil Sayed, a Hamas leader who was killed by Israel in 2024, the NNA reportedAFP, BEIRUTThe Israeli military on Monday launched strikes on southern and eastern Lebanon, Lebanese state media reported, after warning it would hit what it called Hezbollah and Hamas targets in four villages. It later reported a new series of strikes near the southern towns of Saksakiyeh and Sarafand, without prior warning. Despite a year-old ceasefire between Israel and Hezbollah, Israel carries out regular strikes on Lebanon, usually saying it is bombing Hezbollah sites and operatives, and occasionally Hamas targets. All four of Monday’s targeted villages are located north of the river. Lebanon’s Cabinet is to meet tomorrow to discuss the army’s progress, while the ceasefire monitoring committee — comprising Lebanon, Israel, the US, France and UN peacekeepers — is also set to meet this week.

Source:Taipei Times

January 06, 2026 17:35 UTC

Singer’s music disappears from China-based sites

Singer’s music disappears from China-based sitesBy Jake Chung / Staff writer, with CNAThe Internet is abuzz over the sudden and unexplained removal of most of Taiwanese Hakka singer-songwriter Lin Sheng-hsiang’s (林生祥) works from China-based Web sites over the past three days. On China’s major music streaming service, NetEase Cloud Music, Lin’s recent work has been removed, leaving only work dating to the early 2000s, when Lin was with other bands. Hakka singer-songwriter Lin Sheng-hsiang poses for pictures at a news conference in Taipei on Dec. 22, 2021. People online expressed confusion about why Lin’s music — based on his observations of farming villages, the relationship between the city and the countryside, and environmental issues — have been taken down. Lin’s work has won multiple Golden Melody Awards and Golden Indie Music Awards.

Source:Taipei Times

January 06, 2026 17:35 UTC

Air Force lauches search for F-16 pilot ejected off Hualien coast

Air Force lauches search for F-16 pilot ejected off Hualien coastStaff writer, with CNAA captain surnamed Hsin (辛) is believed to have ejected from an F-16V (Block 20) single-seat jet about 10 nautical miles (18.5km) east of Fongbin Township (豐濱) in Hualien County during a routine training mission at 7:29pm yesterday, the air force said. The air force said that it had established an emergency response center and launched a search-and-rescue operation. The fighter took off from Hualien Air Base at 6:17pm for a routine training mission, the air force said. A technician works on an F-16 plane at an air force base in Hualien, Taiwan April 8, 2023. Vessels from the Sixth (Hualien) Coast Guard Corps were expected to be among the first to reach the site, sources said.

Source:Taipei Times

January 06, 2026 17:35 UTC

Head of Ukraine security service resigns, replaced

Head of Ukraine security service resigns, replacedAP, KYIVUkrainian President Volodymyr Zelenskiy on Monday replaced the head of the security service, continuing a top-level reshuffle ahead of a trip to Paris where he hoped to finalize agreements with allies on how to ensure that Russia does not repeat its invasion if a peace agreement is signed. Ukrainian President Volodymyr Zelenskiy, left, shakes hands with former head of the security service Vasyl Maliuk in Kyiv on Monday. Besides being a former deputy prime minister, she also served as Canadian minister of international trade, minister of foreign affairs and minister of finance, and helped negotiate trade agreements with both Europe and the US. Freeland and US President Donald Trump have had a sometimes-fraught relationship that could work against Ukraine. During Trump’s first meeting with Canadian Prime Minister Mark Carney in the Oval Office, the president recalled his own antipathy for Freeland.

Source:Taipei Times

January 06, 2026 17:35 UTC

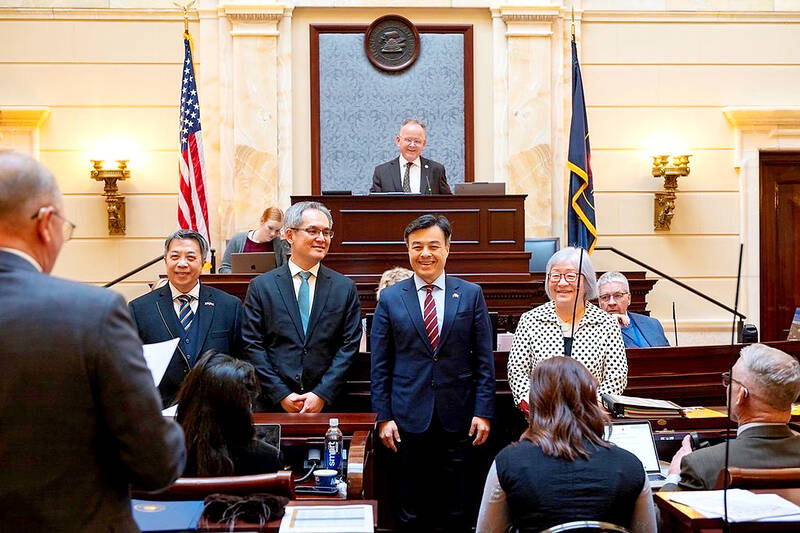

China’s attitude ‘unacceptable’: MEP

China’s attitude ‘unacceptable’: MEPEUROPEAN DELEGATION: President William Lai said that the European Parliament’s staunch support for Taiwan sent the message ‘that the virtuous never stand alone’Staff writer, with CNAThe military exercises China staged around Taiwan last week were provocative and revealed Beijing’s “unacceptable attitude” that threatens “peaceful coexistence across the Taiwan Strait,” Member of the European Parliament (MEP) Michael Gahler said yesterday. Against this backdrop, Gahler, who chairs the European Taiwan Friendship Group, underlined the importance of the European Parliament and democracies worldwide speaking out about maintaining peace in the Taiwan Strait, a condition Gahler said China has attempted to alter. President William Lai, right, shakes hands with Member of the European Parliament Michael Gahler at the Presidential Office in Taipei yesterday. “This is such a provocation and an unacceptable attitude that endangers the peaceful coexistence across the Strait,” he said. In addition to Gahler, the delegation includes MEPs Sven Simon, Wouter Beke, Christophe Gomart, Marion Walsmann, Iuliu Winkler, Michal Szczerba and Jan Farsky.

Source:Taipei Times

January 06, 2026 17:35 UTC

Shifting alliances, create openings

Amid shifting global conditions, Taiwan might soon have a new opportunity to stage a diplomatic reversal in the Americas. When promises go unfulfilled, foreign policy adjusts to meet the political reality in which livelihoods and public trust are key. While Asfura’s election boosts diplomatic confidence in Taiwan, it also underscores the need for strategic evolution. As global supply chains are restructured and awareness of the risks posed by authoritarian expansion grows, more countries are reassessing the costs behind China’s promises. Edwin Yang is an associate professor at National Taiwan Normal University and chairman of the Central Taiwan Association of University Professors.

Source:Taipei Times

January 06, 2026 17:35 UTC

US ‘undermined’ international law in Venezuela: UN

US ‘undermined’ international law in Venezuela: UNAFP, GENEVA, SwitzerlandUS airstrikes on Venezuela and the seizing of the nation’s leader at the weekend clearly “undermined a fundamental principle of international law,” the UN said yesterday. “States must not threaten or use force against the territorial integrity or political independence of any state,” UN rights office spokeswoman Ravina Shamdasani told reporters in Geneva, Switzerland. Photo: Reuters / Miraflores PalaceUS commandos backed by warplanes, the navy and airstrikes forcibly seized deposed Venezuelan president Nicolas Maduro and his wife, Cilia Flores, in the early hours of Saturday. The US and EU say Maduro stayed in power by rigging elections — most recently in 2024 — and imprisoning opponents, while overseeing rampant corruption. “Far from being a victory for human rights, this military intervention ... damages the architecture of international security, making every country less safe,” she said.

Source:Taipei Times

January 06, 2026 17:35 UTC

The Golden Globes kick off Hollywood’s awards season on Sunday

The Golden Globes kick off Hollywood’s awards season on SundayAP, Beverly Hills, CaliforniaThe Golden Globes return Sunday. The boozy, bubbly kickoff to Hollywood’s awards season will feature nominees including Timothee Chalamet, Leonardo DiCaprio, Michael B. Jordan, Ariana Grande, Cynthia Erivo and Emma Stone. Here are more key things to know about the ceremony:Helen Mirren arrives at the 81st Golden Globe Awards on Sunday, Jan. 7, 2024, at the Beverly Hilton in Beverly Hills, California. Mirren will tomorrow be honored with the Golden Globes’ Cecil B. DeMille Award for a life of work on screen. The Globes, held annually in early January, are the first major ceremony of the awards season.

Source:Taipei Times

January 06, 2026 17:19 UTC

Gogoro, Castrol expand cooperation in Vietnam

Gogoro, Castrol expand cooperation in VietnamStaff writer, with CNAElectric scooter brand and battery swapping services provider Gogoro Inc (睿能創意) has decided to expand its cooperation with British lubricant maker Castrol Holdings International Ltd in the Vietnamese market. The company said it would authorize Castrol to market and sell these models in Vietnam, while Gogoro would assist with design and technologies used in new models, it said. Castrol has been in the Vietnamese market for decades, Gogoro said. Ho Chi Minh City is expected to follow, making the Vietnamese market more attractive to Gogoro. In Taiwan, e-scooter sales fell 37.64 percent from a year earlier to 49,228 units last year, including 28,176 Gogoro units.

Source:Taipei Times

January 06, 2026 17:19 UTC