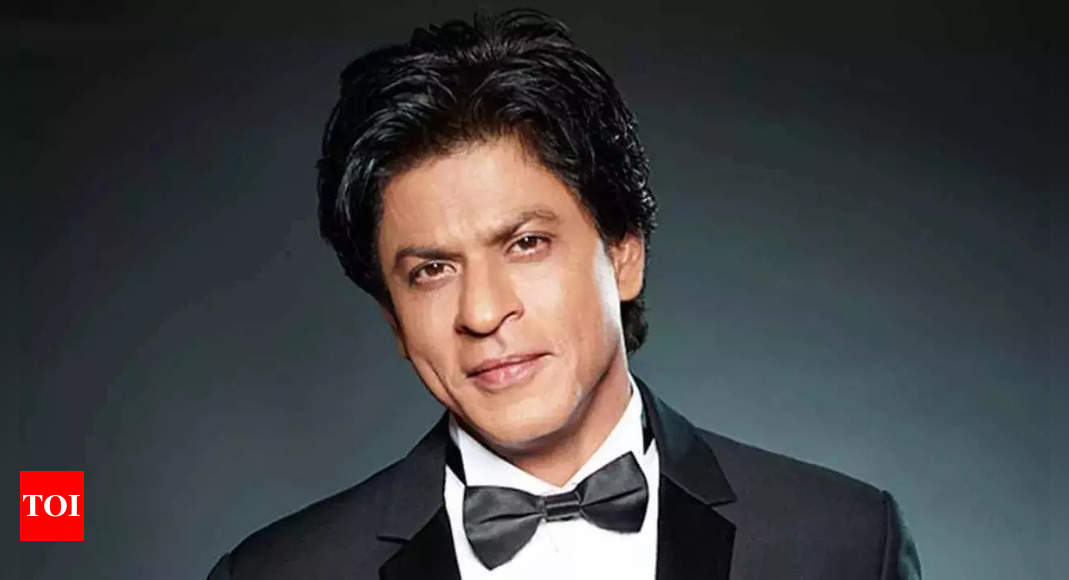

ITAT rules in Shah Rukh favour, quashes reassessment process

The I-T officer denied the actor's claim for foreign tax credit, that was made in his original I-T return.An Indian resident taxpayer is subject to tax in India on his/her global income. In simple terms, foreign tax credit provisions contained in tax treaties, enable an Indian taxpayer to deduct tax paid in the foreign country from his India tax liability. The tribunal noted that the assessing officer had failed to demonstrate any fresh tangible material warranting a reassessment beyond the four-year statutory period. For instance, if the income had escaped assessment due to taxpayer's failure to file an I-T return, or respond to a notice. Or, if the tax taxpayer had failed to fully and truly disclose all material facts during the original assessment.

Source: The Times March 08, 2025 23:47 UTC