How emerging technologies expose Nigeria’s financial system to fraudsters

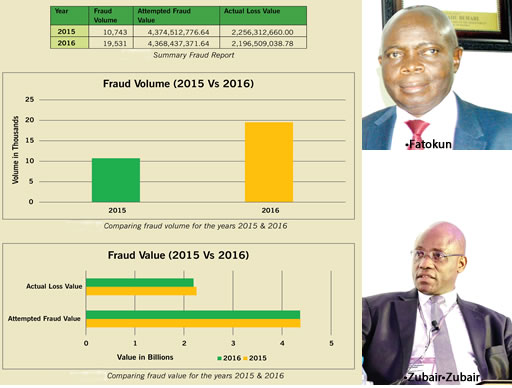

The activities of fraudsters have become very pronounced in the country’s financial services space, especially in the money and capital markets. Current statistics in the financial services sector confirm the prevalence of fraudulent activities given the degree of losses recorded by the various stakeholders in the value chain. Capital market fraud casesOne major event that shook the Nigerian capital market was the case between the Securities and Exchange Commission (the apex regulator of the country’s capital market) and the Group Managing Director, BGL Group, Mr. Albert Okumagba. According to him, technological developments have led to disruptive innovations by financial technology companies in the financial system, of which the innovations have facilitated the expansion of electronic payments and helped in providing financial services to previously unreached groups. “The collaboration between financial technology companies (FinTechs) and banks will always continue to be on the rise; none can displace the other.

Source: Punch December 25, 2017 23:26 UTC