Unconstitutional for Perikatan to function without chairman, says Takiyuddin

KUALA LUMPUR: It will be unconstitutional to change the structure of Perikatan Nasional, says Datuk Seri Takiyuddin Hassan on the alleged abolition of the chairman’s role. The Perikatan deputy secretary-general said the issue of the abolition of the chairman’s role never cropped up and hence such a decision never arose. Citing the coalition’s constitution, he said Perikatan must be led by a chairman along with other senior leaders. If it is changed it will be unconstitutional,” Takiyuddin, who is also PAS secretary general, said at a press conference in Parliament. It was recently reported that former Perikatan chairman Tan Sri Muhyiddin Yassin had said in a letter that Bersatu and PAS had agreed to do away with the post of Perikatan Nasional chairman.

Source:The Star

January 29, 2026 08:27 UTC

Devotees urged to break fewer coconuts for Thaipusam

GEORGE TOWN: Devotees have been urged to reduce the number of coconuts broken during the upcoming Thaipusam celebration amid rising prices. In a joint appeal with the Malaysian Hindu Sangam, CAP called on devotees to stop breaking coconuts in large quantities, many of which end up discarded. Breaking thousands of coconuts only for them to end up in landfills goes against the spirit of the ritual," he said. He added that some devotees, including those from the Chinese community, mistakenly believe breaking more coconuts brings greater good fortune. Subbarow urged devotees to reflect on the practice, especially in the current economic climate.

Source:The Star

January 29, 2026 08:05 UTC

Govt spends over RM200m per year on Bas.My service, ridership on the up — Loke

KOTA BHARU (Jan 29): The federal government spends more than RM200 million annually for the implementation of Stage Bus Service Transformation (SBST), or Bas.My, nationwide. Transport Minister Anthony Loke said public response to the service has been encouraging and continues to trend upward, including in Kelantan, where Bas.My has been fully implemented for more than six months. For Kelantan alone, he said the government allocates more than RM21 million annually to ensure continuity of the Bas.My service. “This means users in Kota Bharu, for example, only pay RM30 for unlimited travel on all 16 Bas.My routes for 30 days,” he said. The Bas.My Kota Bharu service covers 16 routes across 11 local authority areas, including Kota Bharu Municipal Council (Islamic City), and the district councils of Bachok, Gua Musang, Ketereh, Kuala Krai, Machang, Pasir Mas, Pasir Puteh, Tanah Merah, Tumpat and Jeli.

Source:The Edge Markets

January 29, 2026 07:47 UTC

Bukit Aman records statement from Albert Tei over allegations involving Azam Baki

KUALA LUMPUR (Jan 29): Businessman Albert Tei Jiann Cheng arrived at Bukit Aman at about 10.44am on Thursday to record a statement in connection with a police report lodged by the Malaysian Anti-Corruption Commission (MACC) over his alleged defamatory remarks against MACC chief commissioner Tan Sri Azam Baki. Tei, who was accompanied by his lawyers N Surendren and Mahajoth Singh, concluded the statement-recording process at about 12.40pm. Earlier, Surendren, at a press conference, said that his client had been summoned to Bukit Aman on Thursday to assist in an investigation under Section 233 of the Communications and Multimedia Act and Section 500 of the Penal Code. On Nov 27, an MACC officer lodged a police report over a viral video clip on social media featuring a woman and Tei, containing allegations against Azam.

Source:The Edge Markets

January 29, 2026 07:30 UTC

Global gold demand hits record high in 2025, WGC says

Global gold demand rose by 1% in 2025 to 5,002 metric tons, the highest number on record, the World Gold Council said on Thursday. Gold investment at a record highThe WGC expects another year of strong inflows into gold-backed exchange-traded funds and robust demand for bars and coins. ETFs saw inflows of 801 tons of gold in 2025, while demand for bars and coins jumped 16% to a 12-year high. Overall gold investment demand soared 84% to a record high of 2,175 tons in 2025. Gold jewellery demand fell 18% in 2025, with buying in China down 24% at its lowest since 2009.

Source:The Edge Markets

January 29, 2026 07:30 UTC

331 GISBH money laundering cases consolidated before single judge

SHAH ALAM (Jan 29): A total of 331 money laundering charges involving more than RM38.1 million against the former chief executive officer and three accountants of GISB Holdings Sdn Bhd (GISBH) will be heard before the same judge. The charges involve Nasiruddin Mohd Ali, 67, who faces 77 counts amounting to RM10 million; Hamimah Yakub, 74, with 95 counts involving RM11.4 million; Asmat @ Asmanira Muhammad Ramly, 46, with 68 counts involving RM4.7 million; and Mohd Khushairi Osman, 55, who faces 91 counts involving almost RM12 million. During proceedings on Thursday, Deputy Public Prosecutor Mohd Ashrof Adrin Kamarul said applications to consolidate the cases had been made earlier in all relevant courts. On Sept 10 last year, Nasiruddin and the three former accountants pleaded not guilty at the Shah Alam Sessions Court to the money laundering charges. The offences were allegedly committed at bank branches across Selangor between 2020 and 2024, involving transactions to several parties, including accounts belonging to GISBH, GISB Mart Sdn Bhd, GISB Travel and Tours Sdn Bhd, and a childcare centre operator.

Source:The Edge Markets

January 29, 2026 07:25 UTC

Johor fire chief warns against open burning amid peat and grass fires

State Fire and Rescue Department chief Siti Rohani Nadir urged the public not to engage in open burning, particularly under the current hot, dry and windy conditions. - NSTP file picJOHOR BARU: A series of fires, including peat, grass and waste site blazes, have swept across several districts in Johor over the past week. Other minor grass and waste site fires, ranging from 0.21 to 8.09ha, have levels of containment between four per cent and 90 per cent controlled. She urged residents not to engage in open burning, particularly under the current hot, dry and windy conditions, and to report any open fires immediately to authorities via 999. So far, the peat fires have been restricted, with the larger areas fully extinguished.

Source:New Strait Times

January 29, 2026 07:21 UTC

Modi flags EU trade deal, reforms as US pact remains elusive

(Jan 29): India’s free trade deal with the European Union offers the nation’s manufacturers duty-free access to a large market, helping them establish the country’s brand globally, Prime Minister Narendra Modi said. He pledged to build on the recent deal by promising more reforms to boost economic growth. “We are moving fast on the reform express,” said Modi while speaking to reporters outside the parliament in New Delhi. “The country is moving out of long-term pending problems to a long-term solution position now at a great pace.”With a trade deal with the US still elusive, Prime Minister Narendra Modi is leaning more heavily on domestic reforms to sustain growth. The government is expected to push measures to improve the ease of doing business and lift investment as external demand remains under pressure.

Source:The Edge Markets

January 29, 2026 07:15 UTC

MA63: 16 remaining claims at discussion stage — Mustapha Sakmud

KUALA LUMPUR (Jan 29): The remaining 16 claims under the Malaysia Agreement 1963 (MA63) are still under negotiation, with one categorised as partially or interimly resolved, and two having reached a policy decision, the Dewan Rakyat was told on Thursday. Minister in the Prime Minister's Department (Sabah and Sarawak Affairs) Datuk Mustapha Sakmud said that eight other claims remained under discussion, while five more had been referred for deliberation at the highest level. He said this in response to a question from Datuk Matbali Musah (GRS-Sipitang) on the direct benefits anticipated for the people of Sabah and Sarawak from the improvements to the MA63 structure. He said the government’s commitment was further demonstrated through significant fiscal support, with Sabah and Sarawak receiving development allocations of RM6.9 billion and RM6 billion respectively in 2026. For more Parliament stories, click here.

Source:The Edge Markets

January 29, 2026 07:00 UTC

EAIC backs PM’s stand on enforcement integrity

KUALA LUMPUR: The Enforcement Agency Integrity Commission (EAIC) has expressed its support for Prime Minister Datuk Seri Anwar Ibrahim during his mandate session with heads of enforcement agencies. EAIC chairman Tan Sri Dr Ismail Bakar said the Prime Minister’s remarks were in line with the commission’s ongoing monitoring and investigations into misconduct, including abuse of power and weaknesses in the public service integrity governance ecosystem, particularly within enforcement agencies. “Recommendations for disciplinary action put forward by the EAIC, including proposals to improve internal systems and procedural mechanisms, must be given due attention and fully complied with. He added that firm action and strict compliance by department heads were crucial to strengthening enforcement integrity and restoring public confidence in national institutions. Smuggling, corruption, and other illicit activities not only undermine the credibility of enforcement agencies but also betray the interests of the people and the nation.

Source:The Star

January 29, 2026 06:34 UTC

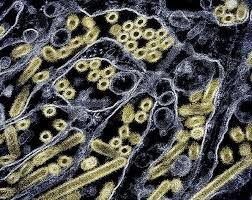

Vietnam calls for enhanced Nipah virus surveillance

HANOI: Vietnam's Ministry of Health has urged local authorities to strengthen surveillance and promptly detect suspected cases of Nipah virus infection at border gates, medical facilities and in communities to prevent potential spread, especially during the Lunar New Year holiday and the upcoming festival season, local daily Suc Khoe & Doi Song reported on Wednesday (Jan 28). Hospitals under the ministry's management have been asked to be ready to receive, isolate and treat patients who are confirmed or suspected to be infected with the virus. According to the ministry, Vietnam has so far not recorded any human cases of Nipah virus infection. The ministry said it will continue to closely monitor the situation and coordinate with the World Health Organisation and other partners to ensure timely and effective prevention and response measures.

Source:The Star

January 29, 2026 06:24 UTC

Blackpink's Lisa named Amazing Thailand ambassador

BANGKOK: Lalisa "Lisa” Manobal (pic) of Blackpink has been named the Amazing Thailand Ambassador under the "Feel All the Feelings” campaign. Thapanee added that TAT continues to strengthen confidence in Thai tourism through the Trusted Thailand initiative, positioning the country as a quality destination that travellers can trust and choose with confidence. She said TAT believes that showcasing Thailand’s beauty through Lisa’s perspective will help travellers view the country as a leading quality destination, with depth beyond its scenic attractions. "Every experience carries value, and every moment of travel - whether through people, culture, ways of life or atmosphere - is meaningful," she said. "We want each visit to create long-lasting memories that inspire travellers to visit Thailand, return and share their stories.” - Bernama

Source:The Star

January 29, 2026 06:09 UTC

Malaysia must position itself as tech nation, align capital, policy and industry: Liew

KUALA LUMPUR: Malaysia must shift its mindset from being primarily a trading nation to positioning itself as a technology nation, aligning capital, policy and industry to unlock the full potential of its existing advanced capabilities, said Deputy Finance Minister Liew Chin Tong today. He said aligning policy, money and industry was critical because more could be achieved economically with better alignment. Liew said Malaysia already has very sophisticated and complex capabilities in parts of its industrial ecosystem, particularly in semiconductors and semiconductor-related equipment. There has not been a concerted effort to align and proliferate horizontal integration within the ecosystem, and the current priority should be to link more advanced capabilities across sectors, he said. He added that global conditions have created a window of opportunity for Malaysia to organise itself technologically.

Source:New Strait Times

January 29, 2026 06:05 UTC

Former intelligence chief charged with graft

KUALA LUMPUR: Former Malaysian Defence Intelligence Organisation chief Mohd Razali Alias has been charged at the Sessions Court here with three counts of graft involving US$20,000 (RM78,680)and RM64,600. According to the first charge, Mohd Razali was accused of corruptly receiving a US$20,000 bribe from one Sheikh Ahmad Nafiq Sheikh A Rahman. For the second and third charges, Mohd Razali allegedly received for his wife, Datin Azarina Bakia, 59, payments from Sheikh Ahmad Nafiq, who was the Intelligence PC Centre Sdn Bhd director. Mohd Razali allegedly knew the director had links to his official duties. Mohd Razali allegedly committed the offences at the same place on Nov 15, 2024 and April 28.

Source:The Star

January 29, 2026 06:02 UTC

Tighter laws needed to curb fuel theft

Despite these efforts, cases of Singaporeans or Malaysians in Singapore-registered vehicles attempting to fill up on subsidised petrol remain a problem. The video, filmed on Jan 2, went viral and sparked outrage among online users over the lengths some will go to for subsidised fuel. He lamented that there were currently no specific laws to prosecute foreigners who fill foreign-registered vehicles with subsidised fuel. He added that under present law, petrol station operators face fines of up to RM1mil or three years’ imprisonment. Malaysia needs to review and update its laws, especially those governing the sale and purchase of subsidised fuel, so that when a law is broken, both the seller and buyer can be held accountable.

Source:The Star

January 29, 2026 06:00 UTC

.jpg)