Tall order for financial inclusion in Nigeria

The expectation of closing the 16.8% shortfall in the Nigeria financial inclusion target is threatened as the recent EFInA survey on financial services agents shows that the percentage of agents who offer account opening services has decreased significantly since 2015. Agent banking is a key driver of financial inclusion and very useful in providing access to financial services, especially in underserved/unserved areas. The National Financial Inclusion Strategy identified agents as an important channel for achieving the financial inclusion target. However, if agents are not driving account opening, it makes it harder to achieve the national financial inclusion target. The study reveals that financial services agents lose about two per cent of their recurring monthly cost to transactions associated with fraud.

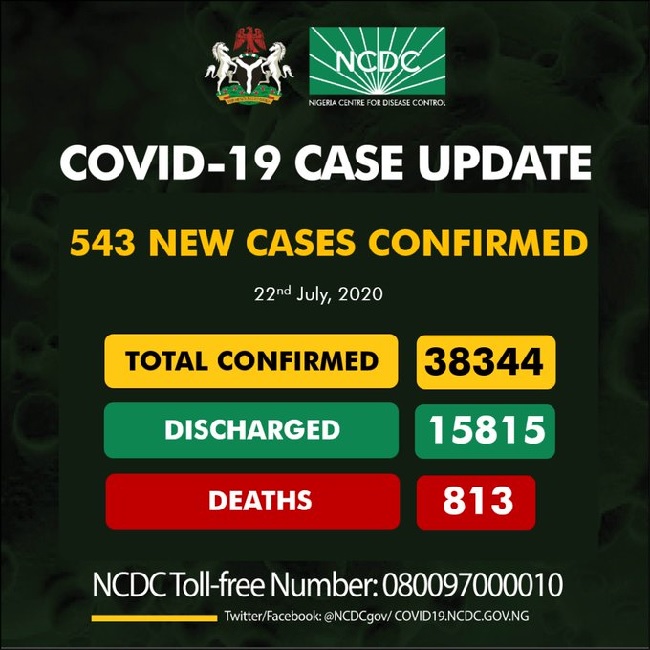

Source: Punch July 22, 2020 23:03 UTC