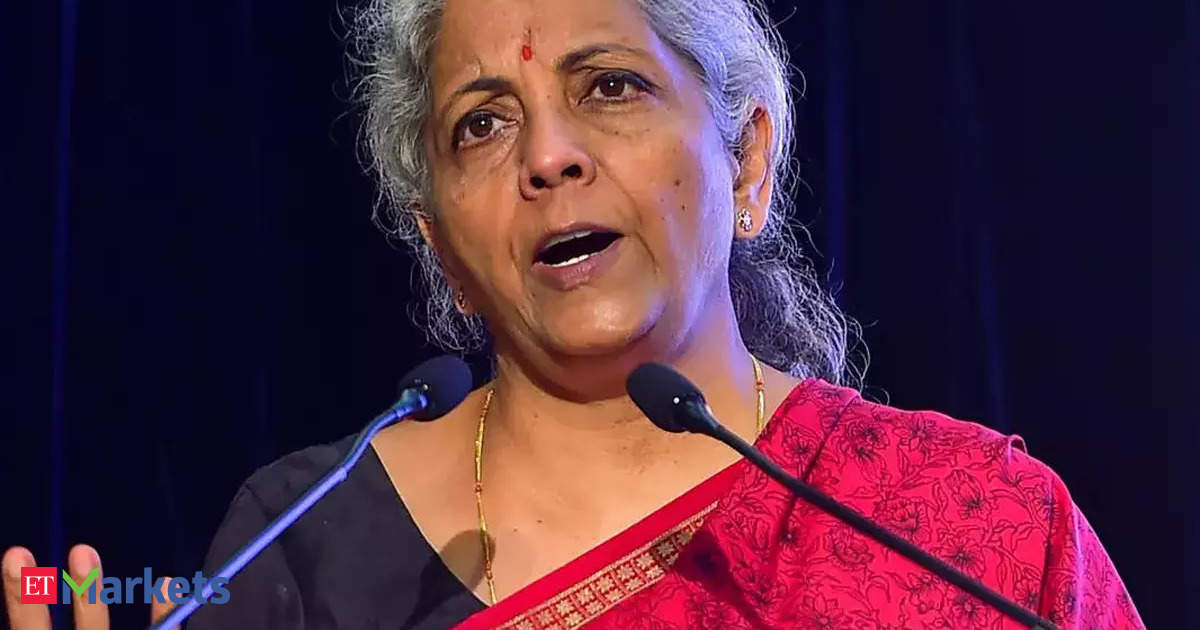

LTCG hike, indexation changes not done for revenue considerations, but to simplify & make sure all asset classes are treated similarly: FM

“What they are going to pay at 12.5% is less than even what they have paid if the indexation were to be there. Because Rs 1,00,000, Rs 5,00,000, Rs 10,00,000, Rs 15,00,000 – that exemption will benefit even the higher income groups.First of all, we intend to give something to the middle-class salaried people. Is the GST tax on the essentials, brought in only by GST? They should come to the NITI Aayog and say, look, my state is getting this much. I will still have money going to states that have not been named in my budget.

Source: Economic Times July 25, 2024 05:17 UTC