Investors in Coca-Cola Consolidated (NASDAQ:COKE) have made a stellar return of 111% over the past five years

One great example is Coca-Cola Consolidated, Inc. (NASDAQ:COKE) which saw its share price drive 107% higher over five years. During the five years of share price growth, Coca-Cola Consolidated moved from a loss to profitability. It is of course excellent to see how Coca-Cola Consolidated has grown profits over the years, but the future is more important for shareholders. As well as measuring the share price return, investors should also consider the total shareholder return (TSR). In the case of Coca-Cola Consolidated, it has a TSR of 111% for the last 5 years.

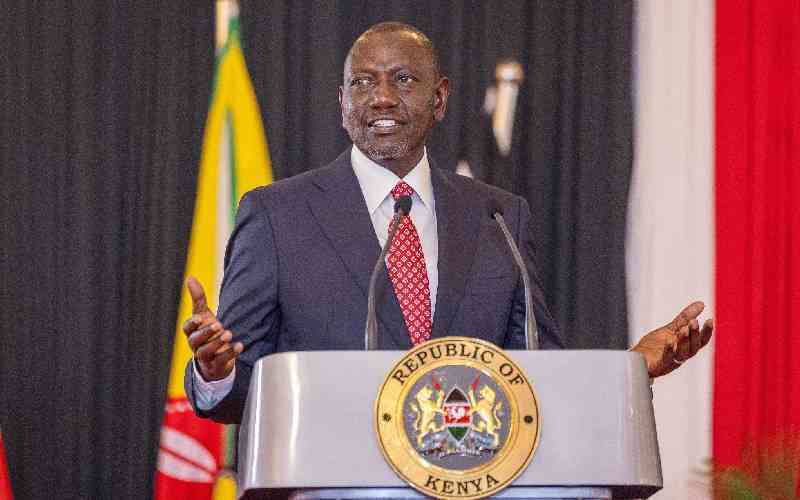

Source: The Star July 25, 2022 19:32 UTC