FSC eases capital requirements for top banks to expand lending capacity

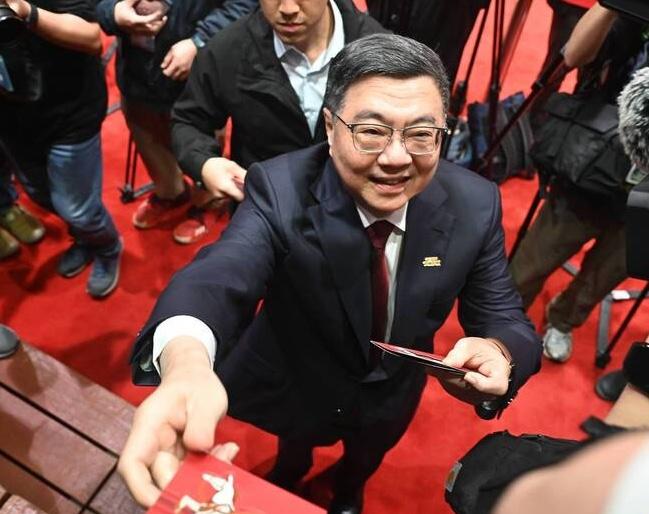

FSC eases capital requirements for top banks to expand lending capacityBy Kao Shih-ching / Staff reporterThe Financial Supervisory Commission (FSC) yesterday said it was easing minimum capital requirements for the nation’s six “domestic systemically important banks” (D-SIB), allowing them to expand lending by NT$400 billion this year to help companies affected by the COVID-19 outbreak. “By relaxing the capital requirements, the six D-SIBs are expected to face less capital management pressure and to increase their risk absorption capacities,” Tong said. To meet a higher common equity ratio requirement, a bank could either boost its common equity or reduce its loans. All six banks met the adjusted capital requirements in the first quarter, Tong said. As corporate loans have a comparatively higher risk weighting of 100 percent, the six banks can approve more corporate loans with the more relaxed capital requirements, he said.

Source: Taipei Times July 01, 2021 15:56 UTC