Capital One's Auto Lending Push Will Hurt If Industry Conditions Deteriorate

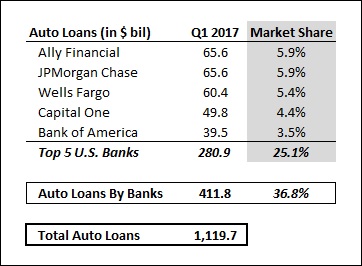

The total auto loans outstanding in the country are taken from the website of the Federal Reserve Bank of St. Louis here. While strong growth in demand for auto loans since 2010 has resulted in banks ramping up their auto lending units considerably over the years, there has also been a sharp increase in sub-prime auto lending. As the first quarter of the year is seasonally a slow period in terms of loan growth, Capital One’s notable jump in auto lending over Q1 2017 is indicative of relaxed lending standards. While auto loan charge-off rates at Capital One are around industry average, we believe that the ongoing normalization in loan charge-off rates across the industry will lead to heavy loan losses for Capital One on its lower-quality auto loans. The chart below shows Capital One’s total auto lending portfolio over the years and our forecast for the metric.

Source: Forbes June 06, 2017 17:49 UTC