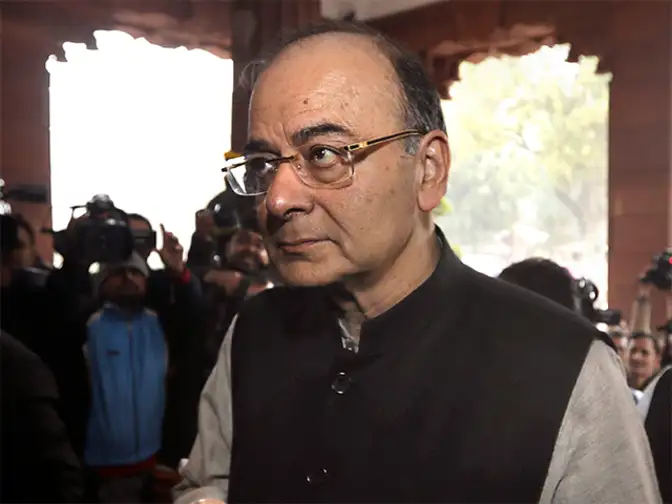

Budget 2017 Highlights: Here are the highlights of Union Budget 2017

Finance Minister Arun Jaitley presented the Union Budget 2017 , his fourth annual budget, today. Here are the highlights of this year's budget:►Income Tax rate cut to 5 pc for individuals having income between Rs 2.5 lakh to Rs 5 lakh►10 pc surcharge on individual income above Rs 50 lakh and upto Rs 1 cr to make up for Rs 15,000 cr loss of due to cut in personal I-T rate►15 pc surcharge on income above Rs 1 cr to continue►Of 3.7 cr individuals who filed tax returns in 2015-16, 99 lakh showed income below exemption limit►Direct tax collection not commensurate with income and expenditure pattern►Revenue deficit reduced to 2.1 pc from 2.3 pc for 2016-17►Govt pegs fiscal deficit target at 3.2 per cent for 2017-18 and 3 per cent for next year.► Monetary policy to be expansionary in major economies► More steps will be taken to benefit farmers and the weaker sections; budget being presented during weak global economy►Pace of remonetisation has picked up; demonetisation effects will not spill over to next year►Functional autonomy of the railways to be maintained►Demonetisation will help in transfer of resources from tax evaders to government:►Merger of Railways Budget with General Budget brings focus on a multi-modal approach for development of railways, highways and inland water transport►Only transient impact on economy due to demonetisation; long term benefit include higher GDP growth and tax revenue►GDP will be bigger, cleaner after demonetisation►Effects of demonetisation not expected to spill over to the next year, says Finance Minister►Effects of demonetisation not expected to spill over to the next year, says Finance Minister►Govt took two tectonic policy initiatives - passage of GST Bill and demonetisation►Demonetisation was a continuation of series of measures taken by govt in 2 yrs; it is bold and decisive measure►We are seen as engine of global growth; IMF sees India to grow fastest in major economies►36 pc increase in FDI flow; forex reserves at USD 361 billion in January enough to cover 12 months needs►CAD declined from 1 pc last year to 0.3 pc in first half of current fiscal: FM►India has emerged as bright spot in the world: FM►Uncertainty around commodity prices especially oil to have impact on emerging economies: FM►Double digit inflation has been controlled; sluggish growth replaced by high growth; war on blackmoney launched: FM►We have moved from discretionary based administration to policy based administration: FM Jaitley► Agricultural sector is expected to grow at 4.1 per cent this fiscal, says Jaitley►Demonetisation was a bold and decisive strike in a series of measures to arrive at a new norm of bigger, cleaner and real GDP►Committed to double farm income in 5 yrs►Plan, non-plan classification of expenditure done away with in the Budget for 2017-18 to give a holistic picture►Mini labs by qualified local entrepreneurs to be set up for soil testing in all 648 krishi vigyan kendras in the country►Budget presentation advanced to help begin implementation of schemes before onset of monsoon►We will continue the process of economic reform for the benfit of poor.►Spend more in rural areas, infra, poverty alleviation, while maintaining fiscal prudence as guiding principle of Budget►Our agenda for next year is to transform, energise and clean India►World Bank expects GDP growth rate at 7.6 pc in FY18 and 7.8 pc in FY19►Allocation under MNREGA increased to 48,000 crore from Rs 38,500 crore. This is highest ever allocation►Rs 9,000 cr higher allocation for payment of sugarcane arrears►Target of agriculture credit fixed at Rs 10 lakh cr in 2017-18►Tax administration honouring the honest is one of the 10 pillars of Budget 2017-18►National Testing agency to conduct all examinations in higher education, freeing CBSE and other agencies►133-km road per day constructred under Pradhan Mantri Gram Sadak Yojana as against 73-km in 2011-14►Govt to set up dairy processing fund of Rs 8,000 crore over three years with initial corpus of Rs 2,000 crore►1 cr households to be brought out of poverty under Antodya Scheme►Participation of women in MNREGA increased to 55 pc from 45 pc in past►Modern law on contract farming will be drafted and circulated to states►Dedicated micro-irrigation fund to be created with a corpus of Rs 5000 crore►Market reforms will be undertaken, states will be asked to denotify perishables from Essential Commodities Act►Space technology to be used for monitoring MNREGA implementation►Sanitation coverage in villages has increased from 42 pc in Oct 2016 to 60 pc, a rise of 18 pc, says FM►We propose to provide safe drinking water to 28,000 arsenic and fluoride affected habitations►To construct one crore houses by 2019 for homeless. PM Awas Yojana allocation raised from Rs 15,000 cr to Rs 23,000 cr►100 pc electrification of villages to be completed by May 2018►27,000 cr on to be spend on PMGSY; 1 cr houses to be completed by 2017-18 for houseless►PM Kaushal Kendras will be extended to 600 districts; 10

Source: Economic Times February 01, 2017 06:11 UTC