Bondholder? Why you should prepare for steeper losses

Institutional investors such as banks and pension funds that report the value of some of their securities based on the current valuation are also looking at paper losses on their balance sheets. Bond yields and prices at the secondary market at the Nairobi Securities Exchange (NSE) usually feature an inverse relationship where a rise in one signals a decline in the other. The 15-year bond sold in July 2019 saw its price touch lows of Sh71 per every Sh100, while a 16-year infrastructure bond sold in October 2019 was also trading at a similar price. On the other hand, a 6.5-year infrastructure bond sold in November 2023 traded at up to Sh104 per unit, making it the only paper trading above par. The biggest bondholders are commercial banks, whose fair value paper losses have at times in the last two years gone into double digit billions due to rising yields.

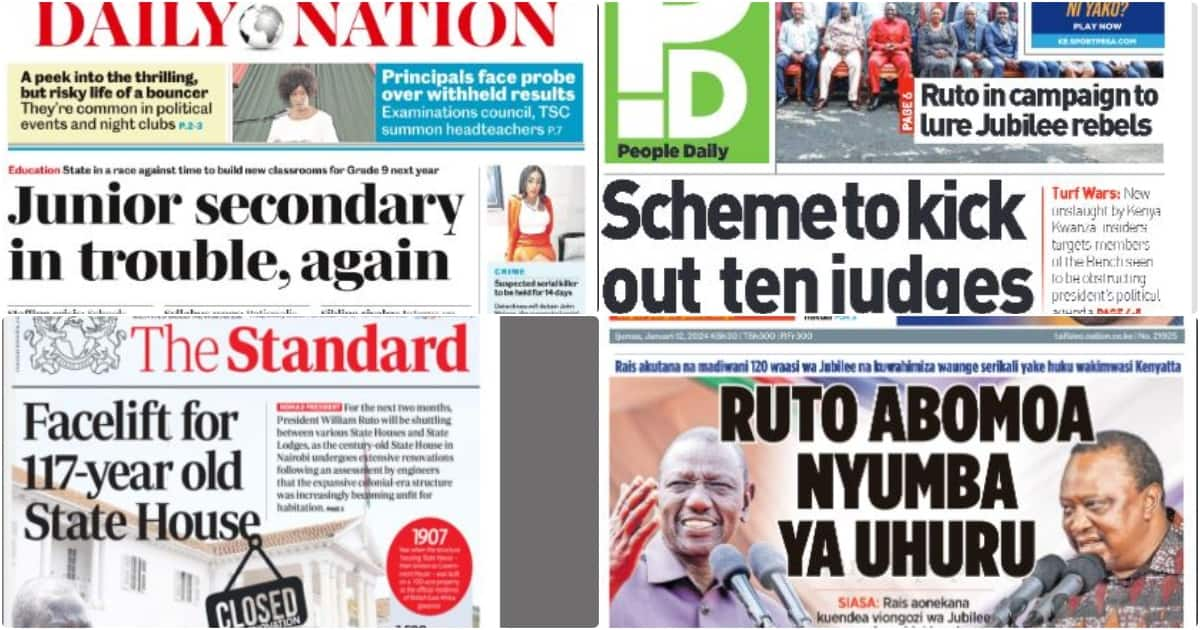

Source: Daily Nation January 12, 2024 05:07 UTC