BNY launches tokenized deposits: Bank money quietly goes on-chain

BNY Melon has launched tokenized bank deposits to enable 24/7 on-chain settlement without changing regulation, compliance, or bank liability. BNY’s move signals how that infrastructure is being adapted for always-on, real-time markets—without changing what bank money legally is. Institutional clients can now move existing bank deposits using blockchain rails, while the money itself remains within BNY’s traditional systems. The direction: Stablecoins serve open liquidity needs, while tokenized deposits are taking shape as the preferred rail for regulated, high-value institutional settlement. As financial markets move toward real-time execution, bank money must move with the same speed and control.

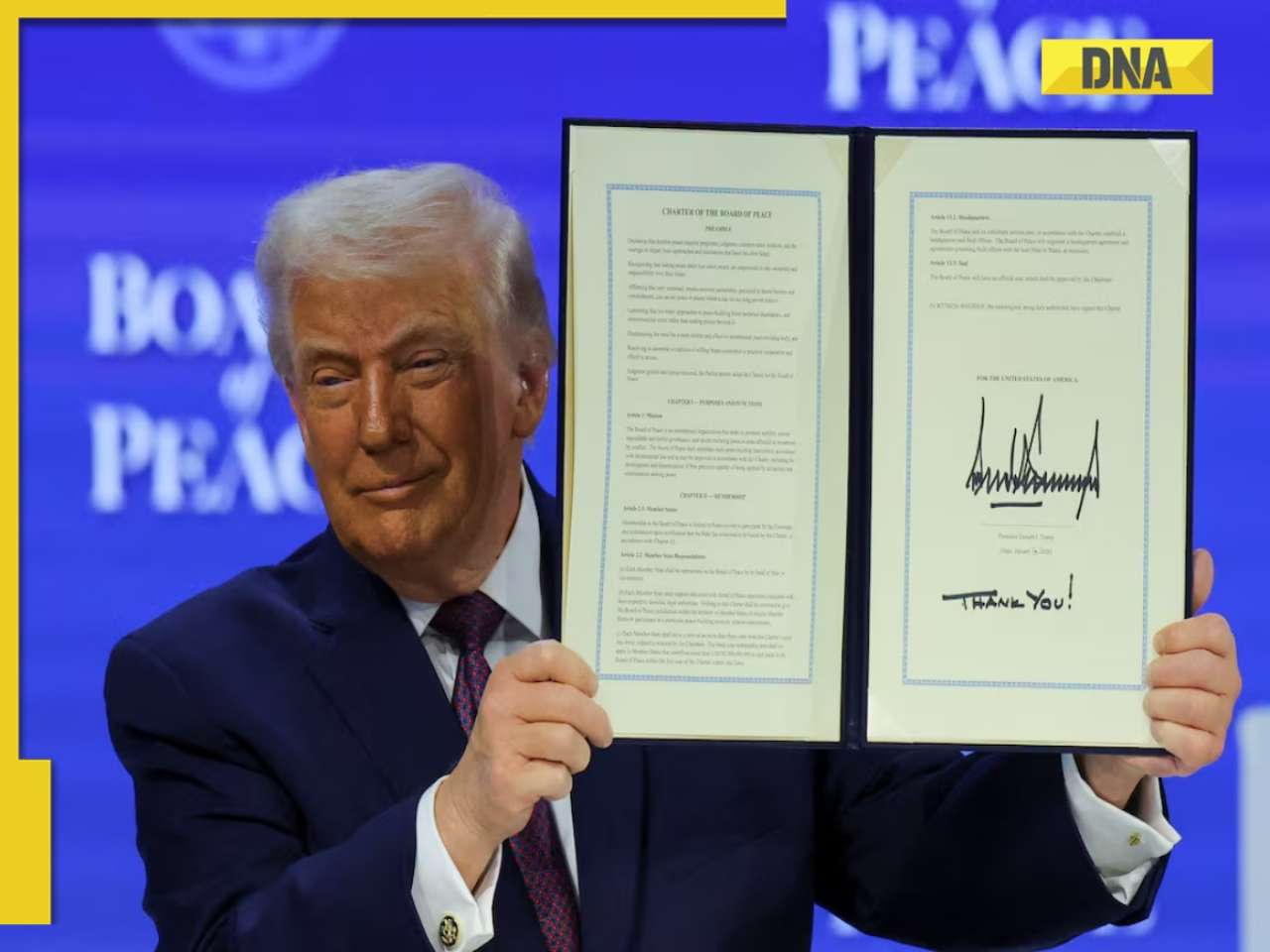

Source: dna January 22, 2026 13:27 UTC